How Intentions fits into financial life

There are only 3 things you can control with money

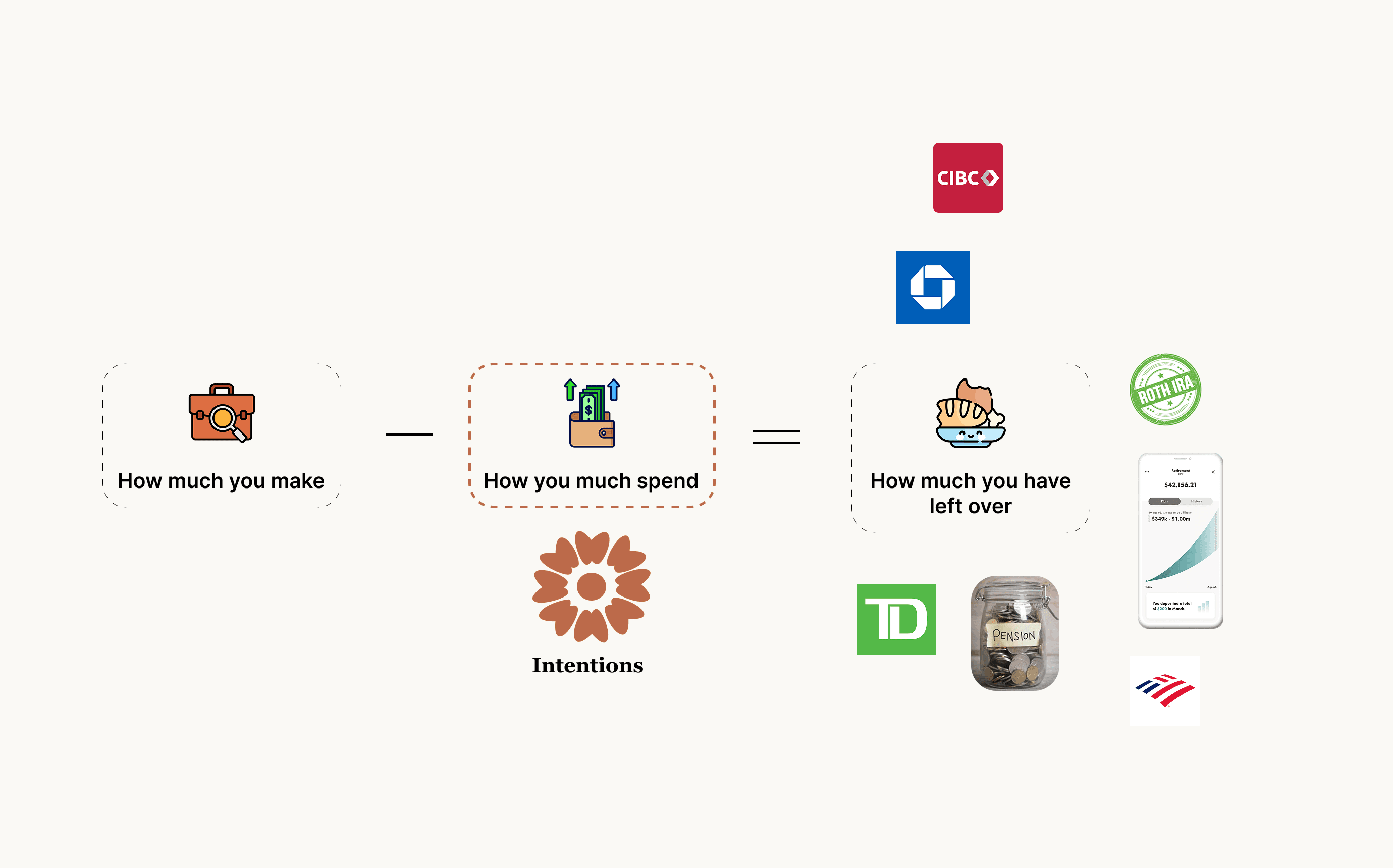

Money can be complicated, and we understand why, there's your Banking app, your Credit cards, TFSA/ROTH, pension, investment apps etc. It becomes a lot, so it's important to understand how another app would fit into the mix.

If you peel it back to the basics there's only 3 important parts:

- How much you make

- How much you spend

- Where you put what's left over (investing)

What we're focused on

We're mostly focused on the first half of the equation, spending and income. Our aim is to help you spend in places that mean the most to you, and in the long run, we believe focusing on developing your skills and interests will make you more money.

What we're not focused on

We are not focused on calculating where you put your money and how it is performing. There are great products like Robinhood or Wealthsimple to help you understand where best to put your money to help it grow. Intentions is really just focused on how you spend.

How does this translate into the product?

We have a very simple savings calculation: Income - Expenses = Savings.

Your savings number is what's left over, which you can use to invest or stash under your mattress. To avoid counting investing as an expense, we recommend "archiving" that transaction. This way your savings number will represent what you put towards investments, or your book-value of your investments.

Life has seasons

Naturally, how much you make, spend, and save is all related. We believe life has seasons. In some seasons you'll be focused on growing your income, this might mean less savings as you're investing in school, courses, projects. In other seasons you might be focused on saving and investing, setting aside money to grow into the future.

How much you decide to save is best determined by you, your circumstances, or with the help of an advisor. Intentions is focused on getting the most out of every dollar you decide to spend and help you learn more about yourself in the process.

Written by Ken Abraham